Changes in Shares and Information on Shareholders

1. CHANGES IN SHARE CAPITAL

The total number of shares and share capital structure of the Company remained unchanged during the Reporting Period.

2. INFORMATION ON SHAREHOLDERS AND ULTIMATE CONTROLLER

(1) Total number of shareholders

|

|

|

|

Total number of ordinary shareholders as at the end of the Reporting Period |

337,216 |

|

|

|

|

Total number of ordinary shareholders as at the end of February 2024 |

310,603 |

|

|

|

(2) Shareholdings of the top ten shareholders and the top ten shareholders of tradable shares (or shareholders of unrestricted shares) as at the end of the Reporting Period

Unit: shares

|

|

|||||||

|

Shareholdings of the top ten shareholders (excluding shares loaned through refinancing) |

|||||||

|

Name of shareholder (Full name) |

Changes |

Number of |

Percentage |

Number of |

Pledge, marking or |

Nature of |

|

|

Status of |

Quantity |

||||||

|

|

|

|

|

|

|

|

|

|

China Telecommunications Corporation |

111,932,400 |

58,476,519,174 |

63.90 |

57,377,053,317 |

Nil |

0 |

State-owned legal person |

|

|

|

|

|

|

|

|

|

|

HKSCC Nominees Limited |

–843,860 |

13,845,981,478 |

15.13 |

0 |

Nil |

0 |

Foreign legal person |

|

|

|

|

|

|

|

|

|

|

Guangdong Rising Holdings Group |

–400,000,000 |

5,214,082,653 |

5.70 |

0 |

Nil |

0 |

State-owned legal person |

|

|

|

|

|

|

|

|

|

|

Zhejiang Provincial Financial |

0 |

2,137,473,626 |

2.34 |

0 |

Nil |

0 |

State-owned legal person |

|

|

|

|

|

|

|

|

|

|

Jiangsu Guoxin Group Limited |

0 |

957,031,543 |

1.05 |

0 |

Nil |

0 |

State-owned legal person |

|

|

|

|

|

|

|

|

|

|

Fujian Investment & Development Group |

–48,000,000 |

920,294,182 |

1.01 |

0 |

Nil |

0 |

State-owned legal person |

|

|

|

|

|

|

|

|

|

|

China Life Insurance Company Limited |

755,451,747 |

766,614,728 |

0.84 |

0 |

Nil |

0 |

Unknown |

|

|

|

|

|

|

|

|

|

|

State Grid Yingda International Holdings |

0 |

441,501,000 |

0.48 |

0 |

Nil |

0 |

State-owned legal person |

|

|

|

|

|

|

|

|

|

|

Guangdong Rising Holdings Group Co., |

400,000,000 |

400,000,000 |

0.44 |

0 |

Pledge |

400,000,000 |

Unknown |

|

|

|

|

|

|

|

|

|

|

Hong Kong Securities Clearing Company |

161,877,123 |

395,027,677 |

0.43 |

0 |

Nil |

0 |

Unknown |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Shareholdings of the top ten shareholders without lock-up restriction |

|||

|

Name of shareholder |

Number of |

Class and number of shares |

|

|

Class |

Quantity |

||

|

|

|

|

|

|

HKSCC Nominees Limited |

13,845,981,478 |

Overseas-listed foreign- |

13,845,981,478 |

|

|

|

|

|

|

Guangdong Rising Holdings Group Co., Ltd. |

5,214,082,653 |

RMB ordinary shares |

5,214,082,653 |

|

|

|

|

|

|

Zhejiang Provincial Financial Development |

2,137,473,626 |

RMB ordinary shares |

2,137,473,626 |

|

|

|

|

|

|

China Telecommunications Corporation |

1,099,465,857 |

RMB ordinary shares |

1,099,465,857 |

|

|

|

|

|

|

Jiangsu Guoxin Group Limited |

957,031,543 |

RMB ordinary shares |

957,031,543 |

|

|

|

|

|

|

Fujian Investment & Development Group |

920,294,182 |

RMB ordinary shares |

920,294,182 |

|

|

|

|

|

|

China Life Insurance Company Limited |

766,614,728 |

RMB ordinary shares |

766,614,728 |

|

|

|

|

|

|

State Grid Yingda International Holdings |

441,501,000 |

RMB ordinary shares |

441,501,000 |

|

|

|

|

|

|

Guangdong Rising Holdings Group Co., Ltd. |

400,000,000 |

RMB ordinary shares |

400,000,000 |

|

|

|

|

|

|

Hong Kong Securities Clearing Company |

395,027,677 |

RMB ordinary shares |

395,027,677 |

|

|

|

|

|

|

Explanation on the securities account |

N/A |

||

|

|

|

|

|

|

Explanation on the voting rights entrusted |

N/A |

||

|

|

|

|

|

|

Description of connected relationship or |

The Company is not aware of any connected |

||

|

|

|

|

|

|

Description of the holders of preference |

N/A |

||

|

|

|

|

|

Unit: shares

|

|

|||||

|

Changes in the top ten shareholders compared with the end of the previous period |

|||||

|

Name of shareholder (full name) |

Add/Exit |

Number of shares lent |

Number of shares held by |

||

|

Total |

Proportion |

Total |

Proportion |

||

|

|

|

|

|

|

|

|

China Life Insurance Company Limited |

Add |

0 |

0 |

766,614,728 |

0.84 |

|

|

|

|

|

|

|

|

Guangdong Rising Holdings Group Co., |

Add |

0 |

0 |

400,000,000 |

0.44 |

|

|

|

|

|

|

|

|

Hong Kong Securities Clearing |

Add |

0 |

0 |

395,027,677 |

0.43 |

|

|

|

|

|

|

|

|

Chengdu Vanguard Capital |

Exit |

0 |

0 |

97,137,900 |

0.11 |

|

|

|

|

|

|

|

|

China State-owned Enterprises |

Exit |

0 |

0 |

— |

— |

|

|

|

|

|

|

|

|

Suzhou High Speed Rail New Town |

Exit |

0 |

0 |

— |

— |

|

|

|

|

|

|

|

Note: China State-owned Enterprises Structural Adjustment Fund Co., Ltd and Suzhou High Speed Rail New Town Economic Development Co., Ltd are not included in the shareholding list provided by the Shanghai Branch of China Securities Depository and Clearing Corporation Limited for inquiry.

Unit: shares

|

|

|||||

|

Shareholdings of the top ten shareholders with lock-up restrictions |

|||||

|

Listing and trading of shares |

|||||

|

No. |

Name of shareholders with lock-up |

Number of |

Date of listing |

Number of new |

Lock-up restrictions |

|

|

|

|

|

|

|

|

1 |

China Telecommunications Corporation |

57,377,053,317 |

2024–08–20 |

0 |

Lock-up for 36 months |

|

|

|

|

|

|

|

|

2 |

Huawei Technologies Co., Ltd |

220,750,000 |

2024–08–20 |

0 |

Lock-up for 36 months |

|

|

|

|

|

|

|

|

3 |

Oriental Pearl Group Co., Ltd. |

110,375,000 |

2024–08–20 |

0 |

Lock-up for 36 months |

|

|

|

|

|

|

|

|

4 |

Sangfor Technologies Inc. |

110,375,000 |

2024–08–20 |

0 |

Lock-up for 36 months |

|

|

|

|

|

|

|

|

5 |

Shanghai Bilibili Technology Co., Ltd. |

110,375,000 |

2024–08–20 |

0 |

Lock-up for 36 months |

|

|

|

|

|

|

|

|

6 |

DBAPP Security Co., Ltd. |

110,375,000 |

2024–08–20 |

0 |

Lock-up for 36 months |

|

|

|

|

|

|

|

|

Description of connected relationship or |

The Company is not aware of any connected relationship |

||||

|

|

|

|

|||

(3) Strategic investors or other legal persons who became top ten shareholders due to allotment of new shares

|

|

||

|

Names of strategic investors or |

Agreed shareholding start date |

Agreed shareholding |

|

|

|

|

|

State Grid Yingda International Holdings Group |

20 August 2021 |

— |

|

|

|

|

|

Description of agreed term of shareholding in |

Lock-up for 12 months from the date of listing, and the |

|

|

|

|

|

3. INFORMATION ON CONTROLLING SHAREHOLDER AND ULTIMATE CONTROLLER

(1) Information on controlling shareholder

1. Legal person

|

|

|

|

Name |

China Telecommunications Corporation |

|

|

|

|

Person in charge or legal representative |

Ke Ruiwen |

|

|

|

|

Date of incorporation |

27 April 1995 |

|

|

|

|

Principal business |

Basic telecommunications services (see license for specific business scope); value-added telecommunications services (see license for specific business scope); chain operation of national internet service premises; operating its group companies and all state-owned assets and state-owned equity interests formed by state investment in the invested enterprises; contracting overseas telecommunications projects and domestic international bidding projects; operation of system integration, technology development, technical services, design and construction, equipment production and sales, advertising and information consultation related to communication and information business; import and export business; hosting exhibitions. (Market entities shall independently select business projects and carry out business activities in accordance with the law; for projects subject to approval in accordance with the law, business activities shall be carried out in accordance with the approved scope after approval by relevant authorities; business activities prohibited and restricted by the industrial policies of the State and the city shall not be carried out.) |

|

|

|

|

Shareholdings in other domestic and overseas listed companies controlled or invested during the Reporting Period |

China Telecommunications directly holds 51.16% equity interest in New Guomai Digital Culture Co., Ltd. and indirectly holds 18.23% equity interest in New Guomai Digital Culture Co., Ltd. through China Telecom Group Sideline Industrial Asset Management Co., Ltd and China Telecom Corporation Limited; It also directly holds 48.99% equity interest in CCS, directly holds 22.50% equity interest in China Broadcasting and Television Guangzhou Network Co., Ltd., and directly holds shares in Postal Savings Bank of China Co., Ltd., People.cn Co., Ltd., Xinhuanet Co., Ltd., China Publishing & Media Corporation Limited, Jiangsu Expressway Company Limited and Fiberhome Telecommunication Technologies Co., Ltd. |

|

|

|

|

Other information |

N/A |

|

|

|

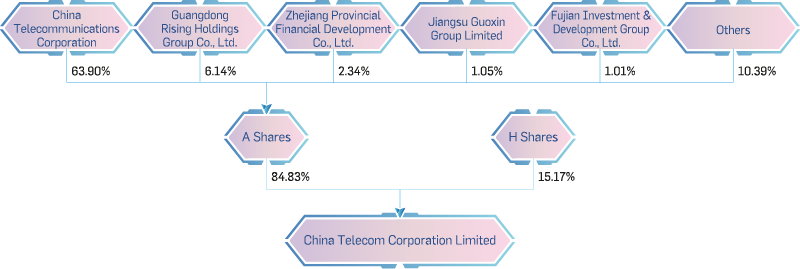

2. Ownership and controlling relationship between the Company and the controlling shareholder

Notes:

1. Data as at 31 December 2023.

2. Guangdong Rising holds 5,614,082,653 unrestricted shares of the Company, accounting for 6.14% of the Company’s total share capital. Among them, 5,214,082,653 shares are held through its own ordinary securities account, accounting for 5.70% of the Company’s total share capital; 400,000,000 shares are held through Guangdong Rising Holdings Group Co., Ltd. — Special account for pledge of non-public issuance of exchangeable company bonds (first phase) for professional investors in 2023, accounting for 0.44% of the Company’s total share capital.

(2) Ultimate controller

1. Legal person

|

|

||

|

Name |

State-owned Assets Supervision and Administration Commission of the State Council (“SASAC”) |

|

|

|

|

|

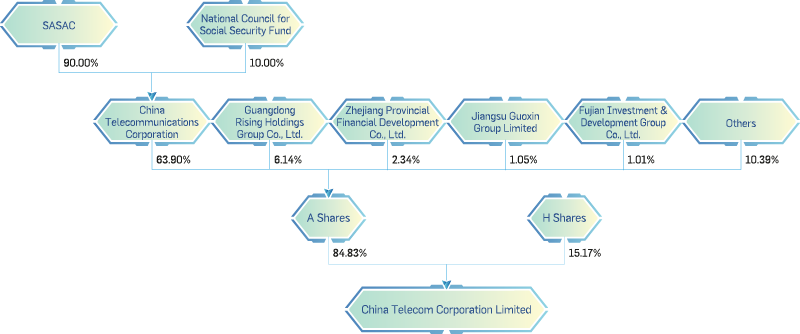

2. Ownership and controlling relationship between the Company and the ultimate controller

Notes:

1. Data as at 31 December 2023.

2. Guangdong Rising holds 5,614,082,653 unrestricted shares of the Company, accounting for 6.14% of the Company’s total share capital. Among them, 5,214,082,653 shares are held through its own ordinary securities account, accounting for 5.70% of the Company’s total share capital; 400,000,000 shares are held through Guangdong Rising Holdings Group Co., Ltd. — Special account for pledge of non-public issuance of exchangeable company bonds (first phase) for professional investors in 2023, accounting for 0.44% of the Company’s total share capital.

4. MATTERS REGARDING THE RESTRICTIONS ON THE REDUCTION OF SHAREHOLDING

(1) Restrictions on the circulation of shares and undertakings by shareholders to voluntarily lock-up their shares

The Company’s controlling shareholder, China Telecommunications, undertakes that:

Within 36 months from the date on which the A Shares of the Company are listed and traded on the SSE, it shall not transfer or entrust others to manage the shares held by China Telecommunications prior to the initial public offering of A Shares of the Company, nor shall the Company repurchase such shares. China Telecommunications undertakes to strictly comply with the Company Law, the Securities Law, the SSE Listing Rules and other laws and regulations, policy requirements and the relevant requirements of the CSRC for prudent supervision, and to determine the lock-up period by adopting a longer applicable period; In the event of future changes in the above laws and regulations and policies, China Telecommunications undertakes to determine the lock-up period in strict accordance with the requirements after the changes. If the shares held by China Telecommunications are reduced within two years after the expiration of the above-mentioned shareholding period, the price of such reduction shall not be lower than the issue price of the Company’s initial public offering of A Shares; if the closing price of the Company’s shares is lower than the issue price for 20 consecutive trading days within 6 months after the listing of the Company, or the closing price at the end of 6 months after the listing of the Company (if such date is not a trading day, the first trading day thereafter) is lower than the issue price, the shareholding period of China Telecommunications shall be automatically extended for at least 6 months.

(2) Undertaking on the intention of shareholding and the intention of shareholding reduction by shareholders holding more than 5% of the shares before the initial public offering of A shares

Each of China Telecommunications, being the controlling shareholder of the Company, and Guangdong Rising, the shareholder holding more than 5% of the shares of the Company, undertakes that:

1. After the initial public offering and listing of A Shares of the Company, it will strictly comply with its undertakings on the lock-up period of its shares. After the expiration of the committed lock-up period, in compliance with the relevant laws and regulations, regulatory documents and the business rules of the stock exchange, it will determine whether to reduce its shareholding in the Company based on factors such as the overall conditions of the securities market, the Company’s operating results and stock trends, and its business development needs.

2. After the initial public offering and listing of A Shares of the Company and the expiration of the committed lock-up period, if it decides to reduce its shareholding in the Company, it will be processed through the block trading system of the stock exchange, the centralised bidding trading system or by agreement as permitted by laws and regulations.

3. If it intends to reduce its shareholding, it shall notify the Company in writing in advance on the information such as the number of shares to be reduced and the reasons for such reduction, and the Company shall perform the information disclosure obligations in accordance with the relevant laws and regulations and regulatory rules. It may implement the reduction after three trading days from the date on which the Company discloses its intention to reduce its shareholding.

4. Reduction of shareholding in the Company will be implemented in accordance with the requirements of laws, administrative regulations, the Several Provisions on Reduction of Shareholding by Shareholders, Directors, Supervisors and Senior Management of Listed Companies and the Implementation Rules for Reduction of Shareholding by Shareholders, Directors, Supervisors and Senior Management of Listed Companies of the Shanghai Stock Exchange. If there are changes in the relevant laws and regulations, regulatory documents and the business rules of the stock exchange, the then effective provisions shall prevail.

5. Reduction of shares of the Company acquired through the secondary market after the initial public offering and listing of A Shares of the Company shall not be subject to the above undertakings.

In the event of failure to perform the above undertakings, it shall take the relevant liabilities in accordance with the relevant laws and regulations, regulatory documents, business rules of stock exchanges and requirements of regulatory authorities.